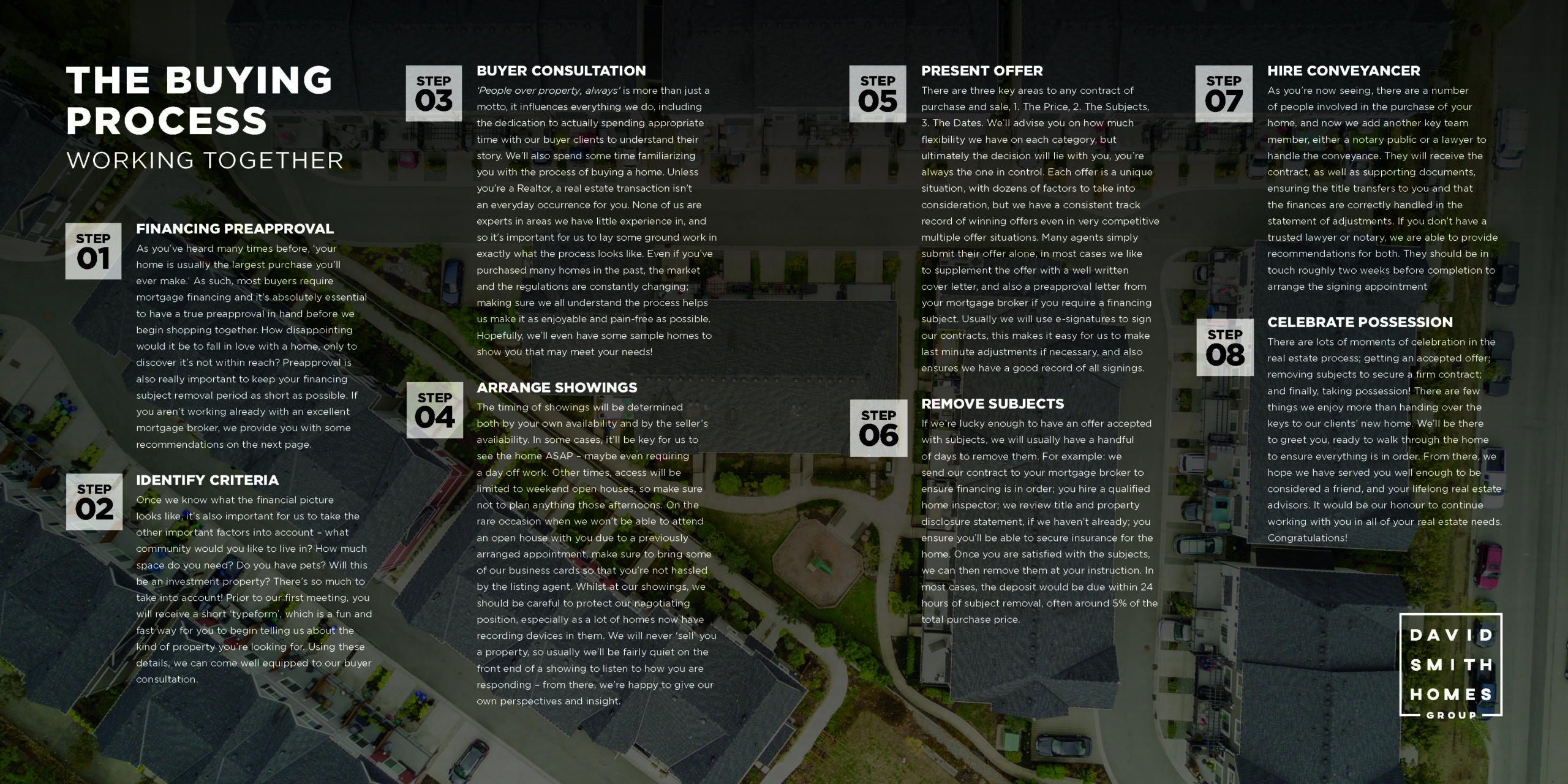

Working Together

Step One – FINANCING PREAPPROVAL

As you’ve heard many times before, ‘your home is usually the largest purchase you’ll ever make.’ As such, most buyers require mortgage financing and it’s absolutely essential to have a true preapproval in hand before we begin shopping together. How disappointing would it be to fall in love with a home, only to discover it’s not within reach? Preapproval is also really important to keep your financing subject removal period as short as possible. If you aren’t working already with an excellent mortgage broker, we provide you with some recommendations on the next page.

Step Two – IDENTIFY CRITERIA

Once we know what the financial picture looks like, it’s also important for us to take the other important factors into account – what community would you like to live in? How much space do you need? Do you have pets? Will this be an investment property? There’s so much to take into account! Prior to our first meeting, you will receive a short ‘typeform’, which is a fun and fast way for you to begin telling us about the kind of property you’re looking for. Using these details, we can come well equipped to our buyer consultation.

Step Three – BUYER CONSULTATION

‘People over property, always’ is more than just a motto, it influences everything we do, including the dedication to actually spending appropriate time with our buyer clients to understand their story. We’ll also spend some time familiarizing you with the process of buying a home. Unless you’re a Realtor, a real estate transaction isn’t an everyday occurrence for you. None of us are experts in areas we have little experience in, and so it’s important for us to lay some ground work in exactly what the process looks like. Even if you’ve purchased many homes in the past, the market and the regulations are constantly changing; making sure we all understand the process helps us make it as enjoyable and pain-free as possible. Hopefully, we’ll even have some sample homes to show you that may meet your needs!

Step Four – ARRANGE SHOWINGS

The timing of showings will be determined both by your own availability and by the seller’s availability. In some cases, it’ll be key for us to see the home ASAP – maybe even requiring a day off work. Other times, access will be limited to weekend open houses, so make sure not to plan anything those afternoons. On the rare occasion when we won’t be able to attend an open house with you due to a previously arranged appointment, make sure to bring some of our business cards so that you’re not hassled by the listing agent. Whilst at our showings, we should be careful to protect our negotiating position, especially as a lot of homes now have recording devices in them. We will never ‘sell’ you a property, so usually we’ll be fairly quiet on the front end of a showing to listen to how you are responding – from there, we’re happy to give our own perspectives and insight.

Step Five – PRESENT OFFER

There are three key areas to any contract of purchase and sale, 1. The Price, 2. The Subjects, 3. The Dates. We’ll advise you on how much flexibility we have on each category, but ultimately the decision will lie with you, you’re always the one in control. Each offer is a unique situation, with dozens of factors to take into consideration, but we have a consistent track record of winning offers even in very competitive multiple offer situations. Many agents simply submit their offer alone, in most cases we like to supplement the offer with a well written cover letter, and also a preapproval letter from your mortgage broker if you require a financing subject. Usually we will use e-signatures to sign our contracts, this makes it easy for us to make last minute adjustments if necessary, and also ensures we have a good record of all signings.

Step Six – REMOVE SUBJECTS

If we’re lucky enough to have an offer accepted with subjects, we will usually have a handful of days to remove them. For example: we send our contract to your mortgage broker to ensure financing is in order; you hire a qualified home inspector; we review title and property disclosure statement, if we haven’t already; you ensure you’ll be able to secure insurance for the home. Once you are satisfied with the subjects, we can then remove them at your instruction. In most cases, the deposit would be due within 24 hours of subject removal, often around 5% of the total purchase price.

Step Seven – HIRE CONVEYANCER

As you’re now seeing, there are a number of people involved in the purchase of your home, and now we add another key team member, either a notary public or a lawyer to handle the conveyance. They will receive the contract, as well as supporting documents, ensuring the title transfers to you and that the finances are correctly handled in the statement of adjustments. If you don’t have a trusted lawyer or notary, we are able to provide recommendations for both. They should be in touch roughly two weeks before completion to arrange the signing appointment

Step Eight – CELEBRATE POSSESSION

There are lots of moments of celebration in the real estate process; getting an accepted offer; removing subjects to secure a firm contract; and finally, taking possession! There are few things we enjoy more than handing over the keys to our clients’ new home. We’ll be there to greet you, ready to walk through the home to ensure everything is in order. From there, we hope we have served you well enough to be considered a friend, and your lifelong real estate advisors. It would be our honour to continue working with you in all of your real estate needs. Congratulations!

If you would like a copy of our full Buyer’s guide, please feel free to complete our Buyer’s Typeform and we’ll arrange a buyer consultation together.